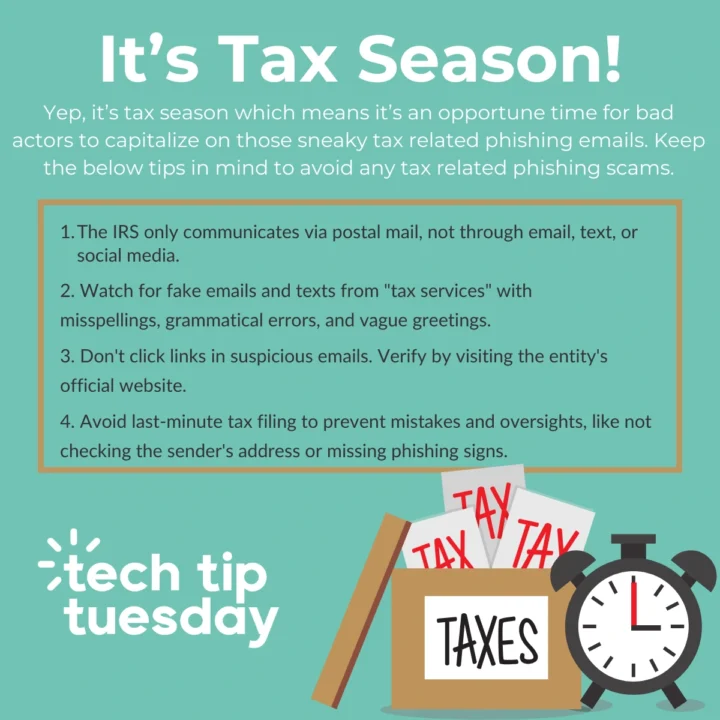

Tax seasons brings scams

Tax season brings a surge in scams, as fraudsters exploit the chaos with tactics like phishing emails and fake tax notifications. Staying alert and informed is key to avoiding their traps. For this tech tip, we emphasize the importance of thoroughly vetting emails to protect yourself from being a victim.

4 signs of tax phishing emails

1. Keep in mind that the IRS doesn’t communicate via email, text, or social media. Expect official correspondence to arrive through postal mail.

2. Exercise caution with emails and texts claiming to be from reputable tax services. Look for misspelled email addresses, grammatical errors, and generic greetings.

3. Should you receive a suspicious email claiming to be from a tax entity, refrain from clicking on any links. Instead, directly visit their official website for authentication.

4. Lastly, avoid procrastination. Rushed actions are more prone to mistakes, such as overlooking sender details or ignoring phishing indicators. Stay vigilant and take your time to ensure security.

Check out this official resource from the United States IRS for more information on recognizing tax scams.

More tips to avoid scams

By staying informed and cautious, you can protect yourself from tax scams and phishing attempts. Remember, a little extra vigilance now can save you from significant trouble later.

Want more tips on how to avoid phishing emails? Read our tech tip over how to spot phishing email signs.